A silent business crisis is unfolding across America, even as economic headlines portray stability and growth. Rising corporate debt, shifting consumer behavior, operational inefficiencies, and an overheated cost structure are quietly pushing thousands of companies toward collapse. This article uncovers the warning signs, real-life examples, and critical questions people are asking as the U.S. braces for a massive, under-the-radar business shake-up.

Introduction: Are We Sleepwalking Into America’s Next Big Business Collapse?

Businesses rarely crash suddenly — they erode quietly before they fall. And today, beneath optimistic stock market gains and upbeat quarterly reports, many American companies are showing signs of severe stress. These struggles are growing in silence, underestimated by the public and masked by numbers that don’t reflect the true fragility of the business landscape.

A 2024 analysis by S&P Global revealed a 45% rise in corporate bankruptcies, the fastest surge since the 2008 recession. The middle market, the economic core that employs millions, is being hit particularly hard. Yet most people, focused on stabilizing inflation and strong consumer spending, fail to see the brewing storm.

This disconnect creates the perfect setup for a business collapse that could reshape the American economy — one that few are talking about, but many will soon feel.

Why Are Businesses Quietly Collapsing Even When the Economy Seems Strong?

This is one of the most widely searched questions today — and rightly so. How can companies fall apart when unemployment is low and GDP is stable?

Because headline numbers hide the deeper cracks.

1. Corporate Debt Is Out of Control

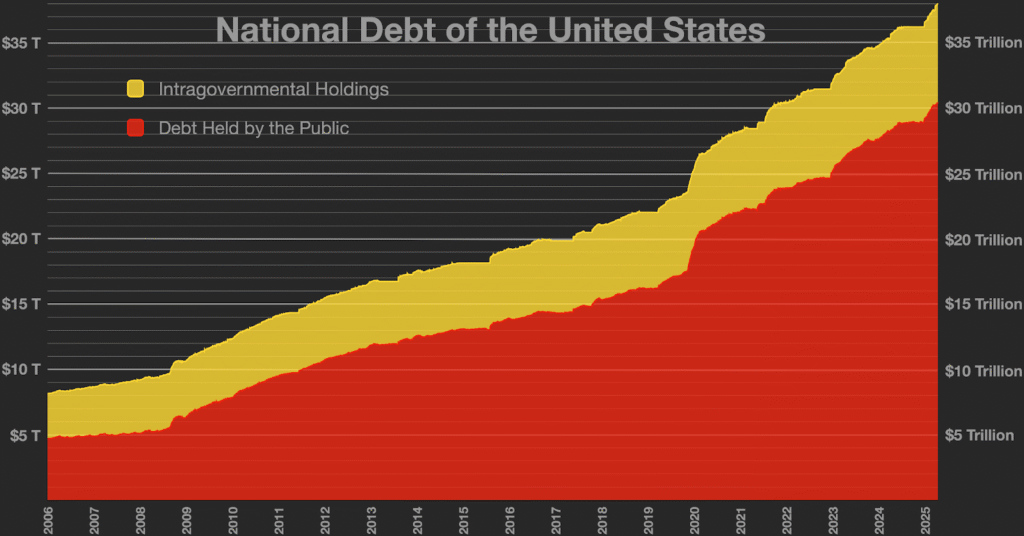

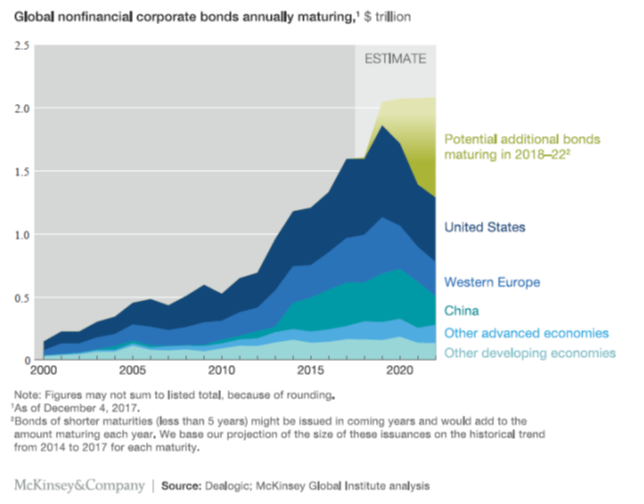

U.S. businesses now carry over $13 trillion in corporate debt, the highest in American history. Much of this debt was taken on during the low-rate pandemic years. Now those loans must be refinanced at double or triple the original interest rates.

Real-life example:

A major retail chain refinanced its debt in 2024 and watched its annual interest payments jump from $30 million to over $110 million. The underlying business wasn’t failing — the new debt terms simply crushed it.

Debt has become the silent executioner of American companies.

2. Consumers Are Spending Differently — Not Necessarily Less

Many companies still operate based on consumer habits from 2016 or 2018. But consumer psychology has changed dramatically.

Today’s shoppers prioritize:

- Value over brand names

- Resale markets

- Subscription-based options

- TikTok-influenced trends

- “Buy now, pay later” spending

Example:

In 2024, several U.S. apparel chains reported an unusual pattern: More store visits, but lower spending per visit. Consumers want deals — not full-price purchases.

Businesses unable to adjust to this shift are losing margin, customers, and relevance.

3. Labor Market Misalignment: The Skills Gap Is Widening

The problem is not simply a “worker shortage.” It’s a skills mismatch.

Companies are desperate for tech-enabled talent, but millions of workers only have traditional skills. Meanwhile, wage expectations continue rising, and companies must compete aggressively to hire or keep staff.

Example:

Restaurant groups across major U.S. cities reported operating at 30–40% below required staffing levels, despite high customer volume. High turnover and wage pressure are destroying their already thin margins.

4. Operational Costs Are Increasing Faster Than Revenues

The cost to simply exist as a business has skyrocketed.

Insurance, utilities, raw materials, shipping, rent, and compliance expenses are all significantly higher than just a few years ago.

Real-life example:

Many long-standing California manufacturing businesses shut down in 2024 because their insurance premiums tripled, making operations financially impossible.

Cost inflation is breaking companies from within.

Are We Already in a “Shadow Recession”?

Economists increasingly warn that the U.S. is experiencing a business recession, even if the overall economy looks stable.

Indicators of a Hidden Business Recession

- Rising business loan defaults

- Quiet layoffs disguised as “performance restructuring”

- Increased use of short-term credit by companies

- Higher commercial real estate vacancy rates

- Falling small-business optimism (NFIB)

- Growing reliance on temporary labor

The consumer-facing economy may still appear healthy, but the business backbone is weakening fast.

Which Industries Are Most at Risk of Collapse (2025–2027)?

1. Retail & Consumer Goods

Resale trends, fast e-commerce competitors, and changing consumer priorities have disrupted the sector.

2. Commercial Real Estate

Remote and hybrid work have left office buildings sitting half empty. Landlords with floating-rate loans are under extreme pressure.

3. Traditional Media & Advertising

Budgets are shifting rapidly toward TikTok, YouTube, and AI content platforms.

4. Small Manufacturing

Energy, labor, and insurance increases have pushed many to the brink.

5. Restaurants & Hospitality

High costs + lower spending = unsustainable financial strain.

Warning Signs a Business Is Close to Collapse

Americans search daily for: “How do I know if a business is failing?”

Here are the clearest indicators:

Early Warning Signs

- Slow communication from leadership

- Changing product quality

- Frequent reorganizations

- Vendor payment delays

- Higher employee turnover

Mid-Stage Trouble Signals

- Closing store locations

- Heavy discounting

- Executives quietly resigning

- Press statements about “strategic reviews”

Late-Stage Collapse Signals

- Lawsuits from creditors

- Rent defaults

- Insiders discussing bankruptcy rumors

Businesses show symptoms long before the public sees the fall.

Are Consumers Unintentionally Contributing to the Collapse?

Yes — indirectly.

Consumers today:

- Are more price sensitive

- Compare costs across multiple apps instantly

- Expect exceptional customer service

- Avoid long-term commitments

- Prefer “value-first” brands

Companies built on outdated pricing models are struggling to adjust. A business that cannot meet today’s demand for convenience, transparency, and affordability is at risk of being replaced quickly.

Technology Is Accelerating the Collapse — Not Preventing It

Tech was supposed to save struggling companies. Instead, it often exposes their inefficiencies faster.

Three Ways Technology Is Speeding Up Business Failure

- Customers easily discover alternatives.

- Automation makes bloated businesses stand out.

- AI lowers the barrier for competitors to enter markets quickly.

A small AI-driven startup today can outmaneuver a multi-million-dollar legacy company in months.

Is Another Major Bankruptcy Wave Coming?

Analysts predict that 2025–2026 may see the largest bankruptcy surge since the 2008 financial crisis.

Key triggers include:

- Corporate debt refinancing deadlines

- Commercial real estate loan maturities

- High-interest rates

- Increased operating costs

- Lower consumer disposable income

Thousands of businesses may not survive the next four years unless conditions shift.

How Can Businesses Protect Themselves from Collapse?

1. Shift to Lean Operations

Trim excess layers.

Automate repetitive tasks.

Adopt cloud-first workflows.

2. Prioritize Cash Flow Over Expansion

Cash reserves determine survival.

Growth without liquidity is dangerous.

3. Modernize Customer Experience

Consumers expect:

- Fast delivery

- Easy returns

- Personalized service

- Clear pricing

4. Reevaluate Debt Structures

Secure fixed-rate financing where possible.

5. Diversify Income

Add digital products, subscriptions, or small-value services for stability.

10 Frequently Asked Questions (Trending Now)

1. Is the U.S. heading into a business recession?

Yes. Many indicators show businesses weakening despite stable employment numbers.

2. Why are companies laying off workers so frequently?

Rising costs, shrinking margins, and refinancing pressure are forcing strategic reductions.

3. Are small businesses more at risk than large corporations?

Absolutely — they have lower cash reserves and weaker access to financing.

4. Which U.S. states are most affected by closures?

High-cost regions like California, New York, and Illinois lead in business shutdowns.

5. Is inflation still impacting businesses in 2025?

Yes. Even mild inflation compounds across logistics, supplies, utilities, and rent.

6. Will AI wipe out traditional businesses?

Not entirely, but companies that resist AI adoption will fall behind rapidly.

7. Why are restaurants closing even with high foot traffic?

Labor, rent, and food costs have risen faster than menu prices can adjust.

8. How severe is the commercial real estate crisis?

Serious — office vacancy rates in major cities are at multi-decade highs.

9. Should consumers worry about major brands disappearing?

Potentially. Several iconic brands are already facing structural financial issues.

10. How long will this collapse last?

Experts estimate 2–4 more years of volatility before stabilization.

Conclusion: The Collapse Isn’t Coming — It Has Already Started

The American business landscape is undergoing one of its most significant transformations in decades. The collapse isn’t a sudden event — it’s a quiet, ongoing unraveling driven by debt, consumer shifts, operating costs, and technological disruption.

The companies that will survive aren’t the biggest — they’re the fastest to adapt.

Businesses must:

- Modernize

- Automate

- Protect cash flow

- Understand today’s consumer

- Embrace agility

The future belongs to those ready to pivot before the collapse becomes impossible to ignore.