Discover how AI is transforming the CFO role in 2025 across U.S. companies — from automation and forecasting to strategy and leadership. Learn how AI is reshaping finance, governance, and the future of decision-making.

In 2025, American companies are witnessing a leadership revolution. Artificial Intelligence (AI) isn’t replacing the Chief Financial Officer (CFO) — it’s partnering with them. By automating routine finance tasks and generating predictive insights, AI allows CFOs to become strategic powerhouses. This article explores whether AI truly is the “new CFO,” how firms are redefining leadership, and how finance teams can adapt and thrive.

What Does “Is AI the New CFO?” Really Mean?

When people ask whether AI is the new CFO, they don’t literally mean an algorithm is about to take a seat in the executive suite. What it really means is this:

- AI is absorbing the operational side of finance — repetitive, rule-based, and data-heavy tasks.

- Human CFOs are shifting toward strategy — focusing on long-term growth, mergers, risk navigation, and board communication.

- The finance function is merging with data science — blurring traditional lines between accounting, analytics, and strategy.

AI doesn’t replace the CFO; it redefines the role. The CFO’s new mission: use AI as a strategic weapon to guide companies through volatility and complexity.

Why Now? Why 2025 Matters for AI and Finance Leadership

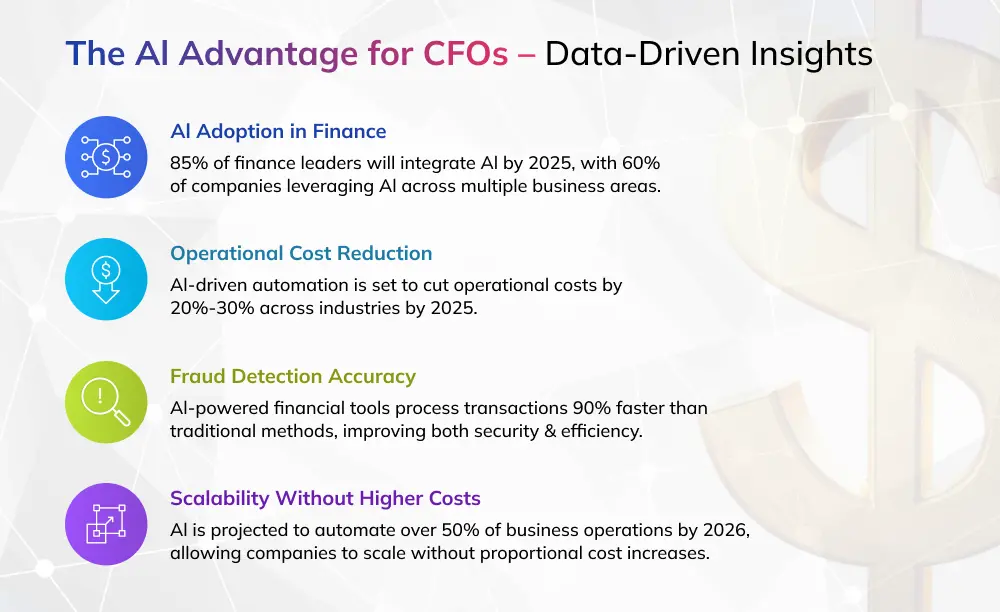

1. The Surge of AI Adoption in U.S. Finance

A recent survey revealed nearly 60% of U.S. CFOs plan to integrate AI into treasury operations within 12 months, compared to just 36% globally (Kyriba).

Other research shows 90% of finance teams will deploy at least one AI-enabled solution by 2026 (Pigment).

AI’s moment in finance isn’t theoretical anymore — it’s operational.

2. Leadership Evolution — From “Controller” to “Strategist”

Two-thirds of CFOs in 2025 say their job has shifted from control to strategy, thanks to AI.

AI automates the grind, enabling finance leaders to become growth architects and trusted advisors.

For many, this shift defines a new era of leadership — a CFO who leads innovation, not just spreadsheets.

3. Competitive Urgency

AI has become a competitive differentiator.

Organizations adopting AI in finance are faster at forecasting, smarter at risk management, and more accurate in planning.

Late adopters risk being left behind, struggling with slower data cycles and less agility.

Real-World Examples: How U.S. Companies Are Rethinking Finance Leadership

Example 1: Enterprise Automation at Scale

A large U.S. manufacturing giant implemented AI-powered forecasting that reduced close-cycle time by 40%.

The CFO could finally step away from reconciliation and devote time to investment planning.

The company’s valuation improved — and its finance function became a model for “strategic agility.”

Example 2: CFO as Growth Strategist

A U.S. financial-services firm reports that its CFO now spends 60% of the time on growth and M&A instead of reporting.

AI dashboards flag emerging revenue opportunities and simulate capital scenarios — turning finance into a growth engine.

This exemplifies how AI repositions the CFO from accountant to corporate strategist.

Example 3: Risk Management Reinvented

A major insurance provider embedded AI in risk modelling and fraud detection.

The CFO now receives real-time alerts for regulatory breaches or anomalies, strengthening governance.

This proactive oversight improved both compliance and investor confidence — proof that AI isn’t just operational, it’s protective.

AI vs Human CFO — Who Does What?

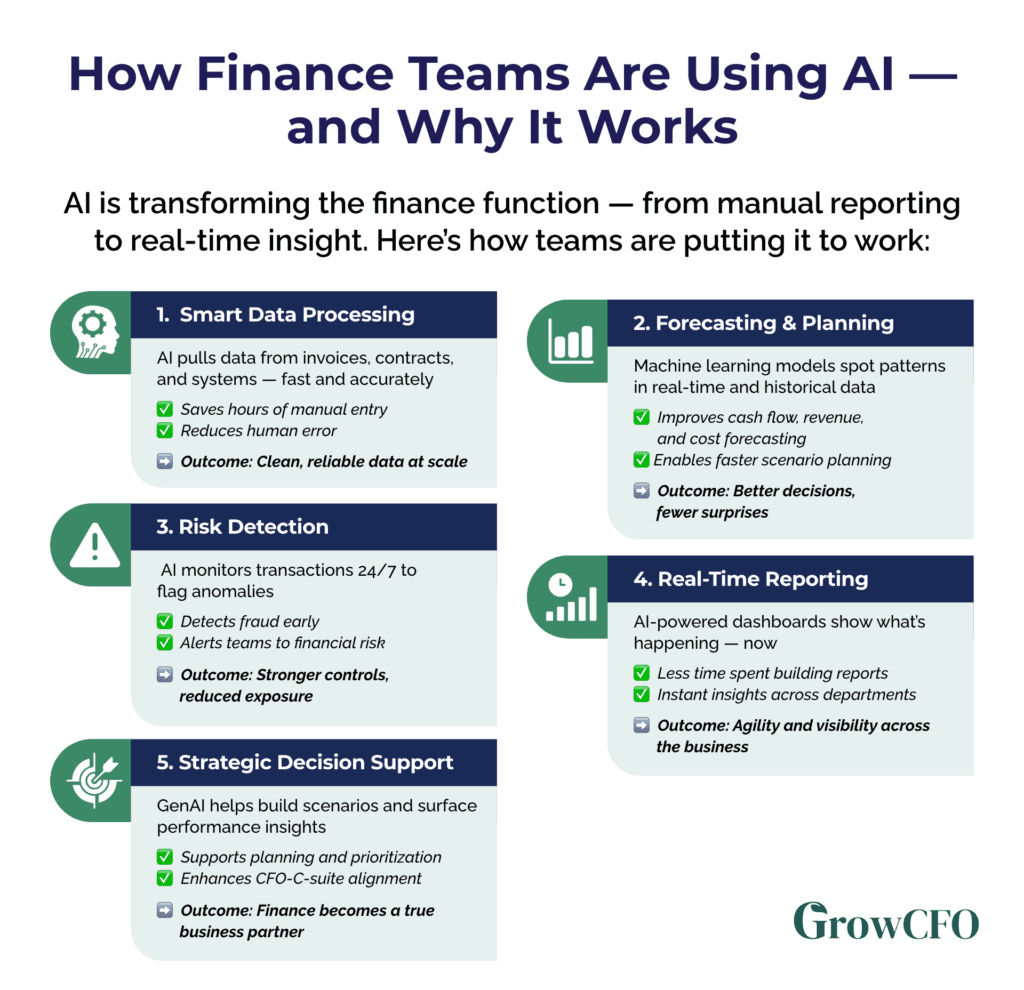

AI Handles the Following:

- Data entry, reconciliation, and invoice processing

- Predictive analytics and scenario simulations

- Fraud detection, anomaly monitoring, and risk alerts

- Generating performance dashboards and visual insights

Human CFOs Focus on These Areas:

- Strategic decision-making and business partnership

- Talent leadership and team development

- Data governance and ethical AI oversight

- Communicating insights to boards and investors

- Leading cross-functional finance transformation

The takeaway: AI is the engine; the CFO is the driver.

How American Companies Are Rethinking Leadership in 2025

Structural Transformation

- CFO titles are evolving: “Chief Finance & Strategy Officer.”

- FP&A, data science, and finance teams are merging.

- Real-time dashboards replace monthly reports.

- Finance is now a strategic co-pilot to operations and product teams.

Talent and Skills Revolution

Modern CFOs need:

- Data analytics literacy

- AI governance knowledge

- Business communication and storytelling skills

- Cross-functional mindsets and agility

Finance is no longer a number discipline — it’s a strategic, digital, and people-centric function.

Board and Investor Expectations

AI is on every board agenda.

Companies must show ROI from AI investments and disclose how they manage AI risk.

In fact, AI-related risk disclosures in SEC filings have grown from 4% in 2020 to 43% in 2024.

Boards expect CFOs to know not only finance, but also machine learning risk, data ethics, and AI compliance.

Myths and Realities About AI as CFO

Myth 1: AI Will Replace the CFO

Reality: AI amplifies the CFO’s value but cannot replicate judgment or trust.

Myth 2: AI Adoption Is a Tech Project

Reality: It’s a cultural and leadership transformation, not just IT.

Myth 3: Only Big Companies Can Afford AI

Reality: SMBs can start with low-code AI tools for forecasting and cash-flow automation.

Myth 4: AI Means Finance Job Losses

Reality: 82% of companies are retraining finance staff for AI roles.

Myth 5: AI Software Is a Magic Fix

Reality: Without quality data, governance, and strategic alignment, AI fails to deliver.

10 Trending FAQs About AI and the Future CFO

1. How Exactly Is AI Transforming the CFO Role?

AI handles data and automation; CFOs handle insight and action.

Automation frees CFOs to focus on strategy and growth, while AI drives precision forecasting and risk management.

Modern finance leaders use AI dashboards to inform decisions in real time — turning data into a strategic advantage.

2. Which Finance Tasks Are Most Automated Today?

Common AI use-cases include:

- Predictive forecasting

- Variance analysis

- Fraud detection

- Accounts reconciliation

- Risk alerts and audit trail creation

Automation reduces manual work and increases accuracy, freeing time for strategic leadership.

3. What Barriers Do CFOs Face with AI Adoption?

Major obstacles include:

- Limited AI talent

- Data fragmentation

- Ethical and regulatory concerns

- Resistance to change

- Measuring ROI

Successful CFOs address these through training, governance, and incremental implementation.

4. How Can Companies Measure AI Success in Finance?

Metrics to track:

- Reduction in closing cycle time

- Forecast accuracy improvement

- Early risk detection

- Cost savings and ROI

- Business impact on growth or margin

AI success is not measured in “tools installed” but in “decisions improved.”

5. What Skills Will the Next-Gen CFO Need?

Future CFOs must blend:

- Financial acumen + data literacy

- AI governance knowledge

- Communication and storytelling

- Strategic mindset and agility

CFOs will be part data scientist, part leader, and part visionary.

6. Will AI Make CFO Roles Obsolete?

No — AI will make them more valuable.

While AI analyzes data, CFOs interpret meaning, context, and long-term impact.

Empathy, ethics, and judgment remain human territory.

7. Can Smaller Companies Benefit Too?

Absolutely.

Even small firms can deploy AI for expense tracking and cash-flow prediction.

As AI tools become affordable, SMBs can achieve enterprise-level financial insight (arXiv).

8. What Risks Does AI Pose to Finance Leadership?

Potential risks include:

- Biased models

- Data security breaches

- Over-automation and loss of human context

- Regulatory non-compliance

CFOs must create AI risk frameworks with audit trails and transparency.

9. How Should a Company Integrate AI Into Finance?

Step-by-Step Roadmap:

- Assess current finance workflows.

- Identify repetitive tasks for automation.

- Clean and structure data.

- Pilot AI in forecasting or compliance.

- Train teams on interpretation and governance.

- Scale based on measurable ROI.

Start small — scale fast.

10. What Will the CFO Look Like in 2035?

The CFO of 2035 will be:

- The Chief Finance & Strategy Officer

- Leading real-time data insight teams

- Operating a fully AI-integrated finance system

- Ensuring ethical AI use

- Acting as a cross-functional navigator of growth

The CFO will be the bridge between AI and human decision-making — a role that defines corporate leadership itself.

Practical Takeaways for Finance Leaders

- Begin AI pilots in one finance process.

- Restructure teams around insight rather than reporting.

- Invest in data quality and integration.

- Build AI ethics and governance frameworks.

- Measure impact in business terms — growth, margin, and speed.

- Communicate AI value to stakeholders.

- Embrace continuous learning and agility.

Final thoughts — Why this matters for your organisation

The transformation of the CFO role via AI is not a distant prediction—it is happening right now in U.S. companies. For finance professionals, business leaders, and organisations, the imperative is clear: embrace the shift, adapt the model, invest in talent and data, and use AI not just as a tool but as a strategic enabler. In doing so, the CFO becomes less a number-keeper and more a value-creator—and that is a powerful shift for leadership, business performance and competitive advantage in 2025 and beyond.