7 Reasons Brands Are Betting Big on Branded Residences in the U.S. – Luxury Real Estate Trends

Explore why top brands are investing in branded residences in the U.S., market growth, investment potential, top examples, risks, and buyer insights for luxury real estate.

Summary

As luxury brands expand into real estate, the U.S. market has seen a surge in branded residences—homes tied to hotels, fashion, or lifestyle brands offering premium services and a unique living experience. This article explores why brands are betting big, market size, investment potential, challenges, U.S. case studies, buyer insights, and SEO best practices for promoting branded residences online.

Why Are Brands Investing in Branded Residences?

Luxury brands are not only selling products or hotel stays—they are selling lifestyles and trust. Branded residences allow them to extend this promise into real estate.

1. Capturing More of the Value Chain

Brands, particularly in hospitality or lifestyle, recognize that residential sales and long-term services can generate recurring revenue beyond one-time transactions. They benefit from property development, ongoing management, and ancillary services like spa, F&B, and concierge.

2. Leveraging Brand Equity for Premium Pricing

Strong brands can command 30–40% higher prices compared to similar non-branded properties. Buyers often pay this premium for guaranteed service standards and exclusivity. For example, Aman New York and Dolce & Gabbana-branded Miami condos have demonstrated significant price premiums. (hospitalitydesign.com)

3. Differentiation in a Crowded Luxury Market

In competitive luxury real estate markets—Miami, Los Angeles, and Manhattan—branded residences differentiate themselves with a lifestyle promise, beyond just high-end finishes. Buyers increasingly value membership in a branded ecosystem over generic luxury.

4. Resilience Against Market Volatility

Branded residences have shown relative resilience during economic uncertainty. Their typical buyers—UHNWIs—are less sensitive to interest rate changes, making these projects safer in terms of long-term value retention.

5. Rising Global Demand & Capital Flows

Worldwide, branded residences have grown more than 150% over the past decade. Many wealthy international buyers see U.S. branded residences as both lifestyle homes and safe-haven assets.

What Exactly Is a “Branded Residence”?

Definition

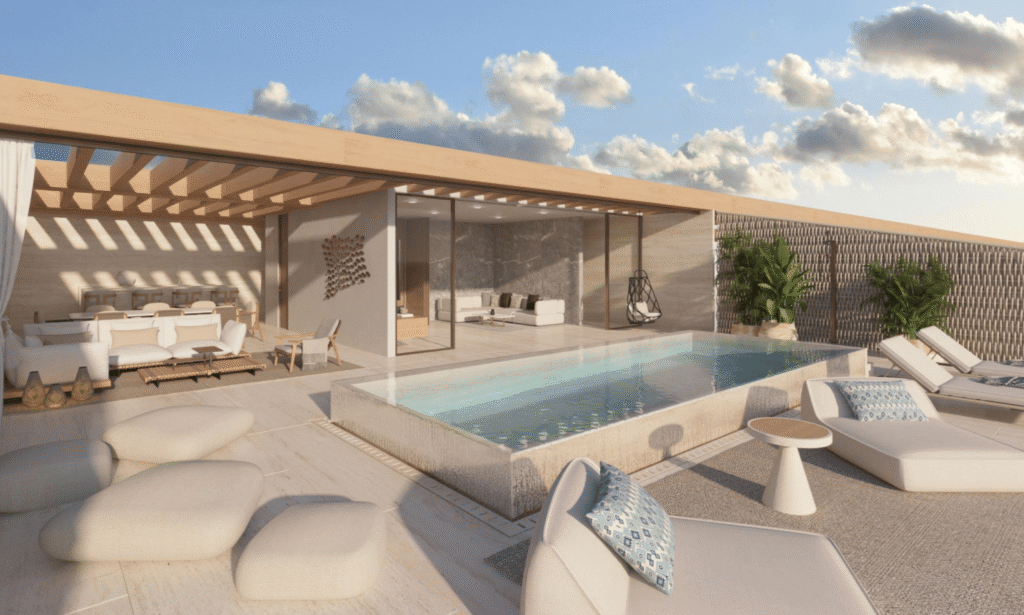

A branded residence is a residential unit—condo, villa, townhouse, or penthouse—linked to a luxury brand under a licensing or management agreement. The brand ensures design standards, amenities, services, and operations aligned with its reputation.

Types of Branded Residences

- Hotel-anchored / integrated: Residences share hotel services like spas, restaurants, and concierge.

- Standalone branded development: A separate building carrying the brand’s design standards and amenities.

- Non-hospitality brands: Fashion, automotive, and lifestyle brands (e.g., Fendi, Versace) partner with developers to provide styling and branding expertise.

Key Contractual Components

- License/management agreements defining brand involvement.

- Service fees and royalty structures.

- Brand standards enforcement for quality assurance.

- Exit and succession clauses for brand changes.

- Liability and risk allocation between brand and developer.

How Big Is the Branded Residences Market?

The branded residences market is booming in the U.S., capturing significant attention from developers and investors.

- North America dominance: About 40% of global branded residence projects are in North America.

- Top U.S. markets: Florida (Miami, Palm Beach), California (LA, Malibu), New York (Manhattan, Hamptons), Massachusetts (Boston), Colorado, Texas.

- Transaction scale: Branded units account for 8–10% of ultra-luxury transactions in top markets.

- Growth projection: 10–12% annual growth rate, demonstrating resilience and investor confidence.

Are Branded Residences a Good Investment?

For buyers, branded residences offer luxury, exclusivity, and potential financial upside.

Benefits:

- Premium resale value: Scarcity and brand reputation often increase value.

- Turnkey luxury living: Fully-serviced, high-standard residences.

- Diversified asset: Combines lifestyle and real estate investment.

- Resilient buyer base: Attracts UHNWIs less affected by market swings.

Considerations & Risks:

- High upfront cost & ongoing fees: Service and management costs are above average.

- Brand dependency: Value depends on brand reputation and operational quality.

- Complex contracts: Licensing agreements may include clauses that affect resale or usage.

- Market saturation: Excess branded projects in a single market may dilute novelty.

Bottom line: Branded residences are strong long-term investments if the brand is reputable and operations are high-quality.

Compelling U.S. Case Studies

Aman New York (Crown Building, Manhattan)

Aman converted the Crown Building into ultra-exclusive residences with hospitality services, proving that even dense urban properties can benefit from strong branding.

Montage and Pendry Residences

Montage hotels integrate luxury residences, leveraging hotel loyalty to drive sales and create a hybrid hospitality-residential ecosystem.

Dolce & Gabbana / Elle Residences – Miami

Fashion brands entering U.S. real estate show that aesthetic appeal and brand prestige can command a premium in high-demand urban markets.

Amangiri Private Residences – Utah

Adjacent to the luxury resort, these residences offer resort-level amenities in a remote, high-end destination, showing the power of lifestyle branding.

How Brands Choose Locations & Partners

Location Criteria

- Affluent demand (UHNWIs, second-home markets).

- Tourism & lifestyle synergy.

- Regulatory and zoning friendliness.

- Real estate upside potential.

- Alignment with brand ethos (wellness brands in resort towns, fashion brands in urban districts).

Partner Selection

- Reputation and track record in luxury real estate.

- Financial stability.

- Brand alignment and shared vision.

- Well-defined contracts to avoid conflicts.

Challenges & Risks in Branded Residences

- Brand dilution / reputation risk: Operational lapses can harm the brand.

- Overpromising vs. under-delivering: Unrealistic service claims may disappoint buyers.

- Contract complexity: Poor agreements lead to disputes over fees, maintenance, and exit rights.

- Market saturation: Too many branded projects can reduce premiums.

- Regulatory & liability risks: Must comply with U.S. real estate, HOA, and safety laws.

- Rising construction & labor costs: High-quality execution is expensive.

- Exit & resale risk: Brand withdrawal or negative performance may hurt resale value.

What Buyers Want — and Fear

Buyer Motivations

- Turnkey luxury living

- Brand assurance and consistency

- Amenities & concierge-level services

- Prestige / social signaling

- Resale value & liquidity

- Wellness and sustainability features

Buyer Concerns

- High service/HOA fees

- Brand exit or operator changes

- Market cycles affecting resale

- Hidden costs for renovations or upgrades

- Contractual clarity

- Operational transparency

Brands that address these concerns with transparency and guarantees succeed in the long term.

FAQ

1. What are branded residences and how do they differ from luxury condos?

Branded residences are residential properties—condominiums, villas, townhouses, or penthouses—linked to a luxury brand such as a hotel, fashion house, or lifestyle company. The brand guarantees certain standards in design, construction, amenities, and services. This can include concierge service, housekeeping, wellness programs, F&B, and even exclusive events.

The main difference from regular luxury condos is the brand’s involvement and promise of consistency. Luxury condos may offer high-end finishes and amenities, but branded residences provide the assurance of the brand’s reputation. Buyers are not just purchasing a home—they are buying a lifestyle and a service experience backed by a trusted name. For example, Aman New York and Montage Residences in California incorporate the operational excellence of the hotel brand, which is something typical luxury condos do not provide.

2. Why do brands choose to enter the U.S. real estate sector via branded residences?

Brands enter U.S. real estate for several strategic reasons:

- Revenue diversification: Beyond selling goods or hotel rooms, branded residences generate recurring revenue through sales, service fees, and ancillary services.

- Global capital access: The U.S. is a top destination for wealthy international buyers looking for safe-haven real estate with luxury services.

- Brand loyalty expansion: Branded residences allow companies to deepen relationships with high-net-worth clients, extending their brand experience from products or hospitality to permanent living spaces.

- Market visibility and prestige: Owning a branded property in the U.S. elevates brand credibility globally, reinforcing brand recognition and trust.

- Resilience: Luxury branded residences appeal to ultra-high-net-worth buyers who are less affected by economic cycles, providing stability in a fluctuating market.

In short, branded residences are a strategic extension of a brand’s lifestyle ecosystem, blending prestige, profitability, and global presence.

3. Which U.S. cities or states are top for branded residences?

The top U.S. markets for branded residences are primarily driven by affluent population density, tourism, lifestyle amenities, and investment potential:

- Florida: Miami, Palm Beach, and Key Biscayne. Miami is particularly attractive for international buyers and lifestyle-driven luxury properties.

- California: Los Angeles, Malibu, Beverly Hills, and San Francisco. Offers both urban and resort-like lifestyles.

- New York: Manhattan and the Hamptons provide high-profile urban luxury with strong resale demand.

- Massachusetts: Boston and Cape Cod for exclusive coastal properties.

- Colorado: Aspen and Vail appeal to mountain resort luxury buyers.

- Texas: Dallas and Austin emerging as high-end luxury lifestyle markets.

These markets combine strong wealth density, global visibility, lifestyle amenities, and appreciation potential, making them ideal for branded residences.

4. How much more do branded residences cost compared to non-branded equivalents?

Branded residences generally sell at a premium of 30–40% compared to similar non-branded luxury properties. Several factors contribute to this price difference:

- Brand equity: The name and reputation of the brand add intrinsic value.

- Service and amenities: Access to hotel-level services and exclusive experiences raises the perceived value.

- Design and quality standards: Brands enforce strict architectural, interior, and operational standards that increase construction and maintenance costs.

- Resale potential: Buyers are willing to pay more upfront for higher expected resale value.

In prime U.S. markets, some branded residences have achieved up to 50% higher resale value within a few years due to scarcity, brand prestige, and lifestyle offerings.

5. What service fees or costs should owners expect?

Owners should anticipate several additional costs beyond the purchase price:

- Branded service fees: Cover concierge, housekeeping, maintenance, and hotel-like services.

- Homeowners’ association (HOA) fees: Cover common areas, landscaping, and shared amenities.

- Reserve funds: Funds for repairs, renovations, and long-term maintenance.

- Special assessments: Occasional costs for capital improvements or unexpected repairs.

- Royalties or license fees: Paid to the brand for use of its name and operational support.

It’s crucial for buyers to review all fees, disclosures, and projected operating budgets before committing to a purchase to avoid unexpected financial obligations.

6. What happens if the brand terminates the agreement or changes operators?

Branded residence agreements usually contain exit or succession clauses, but consequences depend on contract terms:

- Rebranding: Some agreements allow the property to switch to another approved brand if the original exits.

- Operational changes: The management of services (concierge, spa, F&B) may shift to a new operator while maintaining standards.

- Impact on resale and value: A brand departure or downgrade can affect resale value and market perception.

- Buyer protections: Well-drafted contracts include clauses for service continuity, escrow of funds, or alternative management to safeguard owners.

Potential buyers should carefully review brand exit and operator-change clauses before purchase to understand risk and remedies.

7. Are branded residences good investments?

Branded residences can be strong long-term investments if approached strategically:

Advantages:

- Premium resale potential due to scarcity and brand recognition.

- Lifestyle-driven appeal attracts UHNWIs even during economic uncertainty.

- Diversified income through service fees or rental potential if allowed.

Considerations:

- High purchase and ongoing service fees may reduce short-term cash flow.

- Investment value is closely tied to brand performance and reputation.

- Market saturation in certain luxury hubs may impact future appreciation.

Investors should conduct thorough due diligence—review contracts, brand reputation, operating standards, and market trends—to ensure long-term returns align with investment goals.

8. Can non-hotel brands succeed in branded residences?

Yes, non-hotel brands—fashion houses, lifestyle companies, wellness brands, and even automotive companies—are increasingly entering the branded residences space:

- They contribute design expertise, branding cachet, and lifestyle appeal.

- Examples include Dolce & Gabbana-branded Miami condos and Elle magazine residences, where style and branding drive premium pricing.

- Success depends on partnering with experienced developers and hospitality operators to handle operations and ensure service standards.

The key risk is “branding without substance,” where a famous name is used without operational excellence, potentially undermining buyer trust and resale value.

9. How do branded residences integrate sustainability and wellness trends?

Modern buyers expect green and wellness-focused living:

- Sustainability: LEED and WELL certifications, energy-efficient design, low-carbon construction materials, and smart energy systems.

- Wellness amenities: Spas, gyms, meditation rooms, outdoor spaces, and access to wellness programs.

- Smart-home technology: Automated lighting, HVAC, water efficiency systems, and security.

- Healthy design: Natural light, clean air, eco-friendly finishes, and noise reduction.

Integrating these trends increases appeal to conscious luxury buyers and can support premium pricing and long-term value.

10. How do I evaluate a branded residence project before buying?

Evaluation requires a comprehensive approach:

- Brand reputation: Investigate the brand’s experience in real estate and hospitality.

- Developer track record: Ensure the developer has successfully completed luxury or branded projects.

- Contract review: Examine licensing agreements, service guarantees, exit clauses, and fee structures.

- Service & operating budgets: Assess HOA fees, reserves, and projected service costs.

- Market potential: Analyze location, resale trends, and demand for branded residences in that market.

- Quality & design standards: Review model units, architectural plans, and brand oversight processes.

- Legal and tax considerations: Consult a lawyer familiar with U.S. branded residences, real estate, and tax implications.

- References: If possible, speak with current residents or investors in similar branded projects.

Strategic Takeaways & Recommendations

For Brands / Operators: Focus on flagship projects, prioritize quality, choose partners carefully, enforce contracts, maintain brand integrity, integrate sustainability, and embed long-term service revenue.

For Developers: Manage costs, negotiate contracts, understand local laws, pre-sell strategically, market globally, and plan for resale marketing.

For Buyers / Investors: Scrutinize contracts, review service fees, evaluate operating budgets, consider brand strength, and hire experienced legal and real estate counsel.

Final Word

Branded residences in the U.S. combine branding, recurring revenue, lifestyle promise, and real estate capital appreciation. With careful execution, high-quality operations, and a strong brand reputation, these developments are set to define the next decade of premium living in America.