Instagram is growing at 10X the rate of Facebook in the EU with over 281.8M active users vs Facebook’s 263.6M. Learn why, explore real data, country-specific declines, brand case studies, SEO insights, and actionable strategies to stay ahead in 2025.

Instagram is expanding 10× faster than Facebook in Europe, with fresh EU data revealing 281.8M monthly active users compared to Facebook’s 263.6M. From January–June 2025, Instagram grew by 6.17%, while Facebook saw a minimal 0.65% rise. This shift signals a turning point for brands, advertisers, and influencers. In this article, we’ll uncover why Instagram is outpacing Facebook, explore real-life case studies, and provide SEO-friendly strategies to maximize visibility in this evolving landscape.

A Digital Shift in Europe

The European Union (EU) has always been a barometer for digital adoption and a key testing ground for global tech trends. In 2025, one fact has shaken marketers across the continent: Instagram has overtaken Facebook in both scale and growth velocity.

Where Facebook once dominated the European digital scene, it is now seen as a platform experiencing slowed growth, aging demographics, and declining relevance among younger cohorts. Instagram, on the other hand, has captured the imagination of Millennials, Gen Z, and Gen Alpha by offering fast, visually immersive, and interactive experiences.

The result? A 10X acceleration in Instagram’s growth rate compared to Facebook. This article dives deep into the numbers, causes, effects, and opportunities surrounding this social media shift, with the goal of helping brands, businesses, and influencers in the EU and beyond stay competitive.

Section 1: How Instagram Outpaced Facebook in the EU

Breaking Down the Numbers

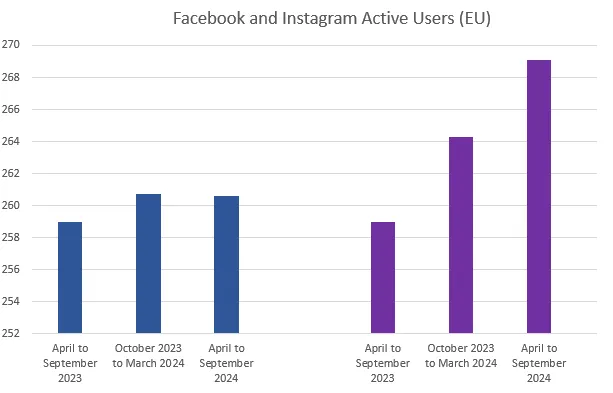

Between March 2024 and June 2025, Instagram saw its user base grow by 6.17%, while Facebook managed only a 0.65% uptick. In terms of raw numbers, Instagram now enjoys:

- 281.8 million monthly active users in the EU.

- A clear lead over Facebook’s 263.6 million users.

- A widening gap of 18.2 million users—and growing.

According to Meta’s own transparency reports released in compliance with the EU Digital Services Act (DSA), Instagram’s explosive growth trajectory is real and accelerating.

Country-Specific Declines in Facebook

Facebook’s slowdown is especially stark in certain EU countries:

- Germany: One of Europe’s largest digital markets, saw noticeable declines in Facebook activity.

- Greece and the Netherlands: Also reported reductions in active Facebook users.

- Southern Europe overall: Younger users appear to bypass Facebook entirely in favor of Instagram and TikTok.

Why Instagram Is Outpacing Facebook

- Youth-Oriented Content: Instagram is tailor-made for short, creative, and visual-first communication.

- Reels and Stories: Two of Instagram’s flagship features dominate content consumption in the EU, where users prefer video to static text.

- Shopping Integration: Instagram’s seamless e-commerce tools—like shoppable tags and direct checkouts—have turned the app into a virtual mall.

- Brand Discovery: With its Explore feed and personalized recommendations, Instagram makes discovering new creators, brands, and trends easier than Facebook ever has.

- Cultural Perceptions: Facebook has, in many circles, become “the platform for parents,” while Instagram remains trendy and aspirational.

Section 2: Why This Matters for Brands and Marketers

The EU’s digital economy is worth billions of euros, and social media platforms drive a large share of advertising and consumer engagement. For brands, the Instagram surge signals a re-prioritization of budgets, strategies, and creative content production.

What Marketers Should Do Immediately

- Rebalance Budgets: Move a significant portion of ad spend from Facebook to Instagram—especially for consumer-facing industries like fashion, beauty, and travel.

- Prioritize Reels: Instagram Reels are favored in the algorithm, delivering better organic reach compared to Facebook video.

- Leverage Micro-Influencers: EU-based micro-influencers on Instagram often outperform large accounts in terms of engagement.

- Think Local: Segment campaigns by EU country, since cultural content preferences vary widely between Germany, Italy, Spain, and Scandinavia.

- Use Shopping Tags: Direct-to-consumer (DTC) brands are seeing conversions spike thanks to Instagram’s built-in shopping ecosystem.

Section 3: Real-Life Case Studies

Case Study 1 – German Apparel Brand

A mid-sized fashion retailer in Berlin shifted 40% of its ad budget from Facebook to Instagram in Q2 2025. The results:

- Engagement up 35%.

- Website traffic from social up 20%.

- Conversions from Instagram ads outpaced Facebook by 2.3x.

Case Study 2 – UK Beauty Creator

A British beauty influencer with 250K followers experimented by reducing long-form YouTube content and doubling down on daily Reels and Stories. Within 8 weeks, she:

- Gained 50K new followers.

- Increased sponsored deal opportunities by 30%.

- Attracted a younger Gen Z audience, diversifying her reach.

Case Study 3 – Netherlands Local Shop

A small bookstore in Amsterdam noticed declining engagement on Facebook posts. After collaborating with local Instagram micro-influencers, the shop saw:

- A 25% increase in foot traffic.

- More international tourists discovering the store via Instagram hashtags.

These examples underline a powerful truth: Instagram is no longer just a secondary marketing channel—it’s the primary driver of consumer attention in Europe.

Section 4: Frequently Asked Questions (FAQs)

To capture AI-driven search queries and voice search trends, here are 10 long-form FAQs with detailed answers.

1. Why is Instagram growing faster than Facebook in the EU?

Instagram’s faster growth is fueled by video-first content, a younger demographic, and seamless shopping integrations. Facebook, while still large, is associated with older generations and less innovation.

2. Is Facebook still relevant in Europe?

Yes, but relevance is declining. Facebook remains strong among older demographics and for community groups, but its role as a growth driver for brands is weakening compared to Instagram.

3. Which EU countries saw the sharpest Facebook declines?

Germany, Greece, and the Netherlands recorded significant drops in user activity. This suggests a regional diversification trend, where southern and western EU nations lean into Instagram more heavily.

4. What features make Instagram so attractive?

Reels, Stories, Explore feed personalization, shopping integrations, and frequent feature updates keep Instagram fresh and engaging.

5. Should brands stop using Facebook entirely?

Not necessarily. Facebook is still valuable for retargeting ads, community building, and B2B connections. However, Instagram should take priority for B2C outreach.

6. Are privacy regulations influencing platform growth?

Yes. With the EU’s Digital Services Act, platforms face stricter rules. Instagram benefits from being perceived as more innovative and “lighter,” while Facebook is weighed down by past data controversies.

7. What does this shift mean for influencers?

It’s a golden age for EU influencers. Instagram creators are commanding higher sponsorship rates and brands are actively seeking them out over Facebook content creators.

8. How can brands optimize for Instagram SEO?

- Use keywords in captions and alt-text.

- Leverage hashtags intelligently (10–15 per post).

- Optimize profile bio with search terms.

- Drive traffic via link-in-bio tools.

9. Does Instagram’s growth in EU signal a global shift?

Likely yes. The EU often acts as a leading indicator for digital adoption trends. If Instagram continues its dominance here, similar patterns may soon be evident in North America and Asia.

10. What should brands expect by the end of 2025?

Expect Instagram to further widen the gap. If current trends hold, Instagram could have 30–40M more EU users than Facebook by December 2025.

Section 6: Emotional & Human Insights

For marketers, this isn’t just about numbers. It’s about cultural resonance. Instagram has become a platform for self-expression, lifestyle inspiration, and aspirational identity-building. In contrast, Facebook increasingly feels transactional and cluttered.

This human angle matters because social media thrives on emotion. A brand that can tell its story visually and emotionally on Instagram will outperform one that relies on traditional static posts on Facebook.

The EU’s shift isn’t just a trend—it’s a signal of the future. Brands who embrace Instagram’s dominance now will be positioned as leaders when similar trends inevitably unfold across other regions.